Klaus Schmidt-Hebbel

La revolución del hidrógeno verde y sus derivados en Magallanes

Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel

El Líbero, 2022

Descripción

La carrera por el desarrollo de la industria del hidrógeno verde está recién comenzando y la Región de Magallanes tendrá un rol protagónico. Cinco grandes proyectos se han anunciado en la zona los que, basados en un potencial eólico único en el mundo, se encuentran entre los primeros que producirán derivados de hidrógeno verde a nivel comercial. Este libro contiene un exhaustivo estudio realizado por Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel, que estima los efectos económicos, sociales y medioambientales que el desarrollo de esta industria tendrá en la Región de Magallanes. Su principal hallazgo es que los proyectos contribuirán significativamente a su desarrollo, transformarán su estructura productiva y harán una gran contribución a la mitigación del cambio climático.

Blurbs

“El ser humano está perdiendo la batalla contra la urgencia climática y no sabemos si podremos sobrevivir al ciclo en el que nos encontramos. Es por esto que el desarrollo de las energías renovables cumple un rol fundamental, vinculado, sin exagerar, a la supervivencia del ser humano en el planeta” Ricardo Lagos, Presidente de Chile 2000-2006

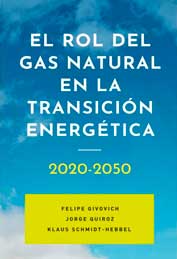

El rol del gas natural en la transición energética. Chile 2020-2050

Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel

El Líbero, 2021

Descripción

La ciencia indica que la única forma de contener el cambio climático es alcanzando la carbono neutralidad global antes del año 2050. Para ello, Chile desarrolló un plan concreto y ambicioso, cuyas etapas iniciales se están comenzando a cumplir. Este riguroso estudio de los economistas Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel viene a complementar la estrategia del país, analizando en particular el rol que puede cumplir el gas natural en la transición energética hacia la carbono neutralidad de Chile. La principal conclusión del libro es que el uso más intensivo de gas en los sectores eléctrico, industrial y transporte permite cumplir un 73% de la reducción de emisiones de gases de efecto invernadero que Chile ha comprometido en el marco del Acuerdo de Paris para el año 2030. Esta sustitución no tiene asociada un costo fiscal.

Blurbs

“Las empresas de gas natural tienen la oportunidad única de estar a la vanguardia del desarrollo carbono neutral del país, y no tengo dudas que este libro de Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel es un gran aporte para avanzar en esa dirección”, Juan Carlos Jobet, biministro de Energía y Minería

“El estudio realizado por Felipe Givovich, Jorge Quiroz y Klaus Schmidt-Hebbel, cuyos resultados se presentan en este libro, es particularmente oportuno. Los autores identifican y evalúan rutas concretas de acción sobre la base de un riguroso análisis económico, opinión técnica y revisión de casos”, Carlos Cortés Simon, presidente ejecutivo, Gustavo Schettini, presidente del directorio Asociación de Gas Natural

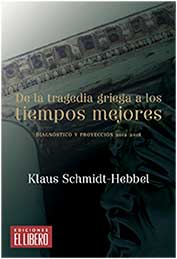

De la Tragedia Griega a los Tiempos Mejores: Diagnóstico y Proyección

Klaus Schmidt-Hebbel

El Líbero, 2018

Description

This book comprises a revised collection of essays on the world economy and Chile, originally published by Klaus Schmidt-Hebbel in Chile’s leading newspaper between 2012 and 2012. The articles cover important international topics – from the Greek crisis to Brexit and from globalization to TPP – and a host of policy challenges and structural reforms in Chile. The author analyzes key issues in economics and politics using a non-technical language, complemented by relevant evidence presented in tables and figures.

Blurbs

“El libro de Klaus Schmidt-Hebbel llega en el momento justo. Nos invita a aprender de los errores del pasado y a implementar sin complejos reformas estructurales que nos permitan retomar la senda del desarrollo. El libro no es la suma de 50 ensayos, sino una conversación profunda donde cada uno de ellos se conecta con el mensaje central del texto: el desarrollo integral de Chile no va a ocurrir en forma automática. Por el contrario, requiere de un importante esfuerzo político y de una hoja de ruta con alta rigurosidad técnica”, Felipe Kast, Senador de Chile

“Una mirada lúcida, amena y, tal vez, conservadora a los grandes cambios en la economía y

política mundial y latinoamericana, incluyendo Chile. Erudición más pluma fácil, hacen de estos artículos una lectura obligada para entender desde la óptica del profesor Schmidt-Hebbel el cambio de época que estamos viviendo en los últimos años. Su lectura enriquece nuestra visión del mundo”, Ricardo Lagos Escobar, ex Presidente de Chile

“Una contribución muy relevante para la comprensión de los problemas y desafíos de la economía mundial. Constituye un análisis crítico y provocativo de las recientes políticas públicas en Chile, con propuestas que invitan a un profundo y necesario debate de ideas”, Alejandra Mizala, Directora del Instituto de Estudios Avanzados en Educación y académica del CEA-Ingeniería Industrial, Universidad de Chile

“Los ensayos de Klaus Schmidt-Hebbel son una amalgama perfecta entre el rigor académico, la opinión fuerte e implacable, y una argumentación inteligente y sagaz. La mente clara y disciplinada de Klaus es capaz de desdoblar su formación de economista para abordar temas muy variados, que sobrepasan los límites tradicionales de la teoría económica para enfocarse en cuestiones tan relevantes para las sociedades modernas como la liberalización de las drogas, la eutanasia y el valor per se de la libertada y la diversidad”, Felipe Morandé, Ex Ministro de Estado y economista

“Aguda y refrescante mirada de la realidad económica, política y social reciente. Un estilo particularmente provocativo que no deja indiferente al lector. Inquisitivo, irónico e hiriente en sus diagnósticos, pero siempre con propuestas de soluciones bien fundamentadas, empapadas de la experiencia internacional, el análisis técnico y, sobre todo, motivado por contribuir a encontrar el camino hacia el desarrollo sustentable”, Andrea Tokman, Economista Jefe Quiñenco S.A

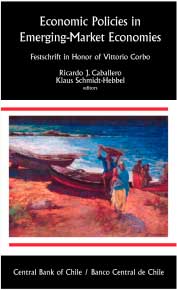

Economic Policies in Emerging-Market Economies: Festschrift in Honor of Vittorio Corbo

Editors: Ricardo Caballero and Klaus Schmidt-Hebbel

Central Bank of Chile, 2015

Description

This Festschrift in honor of Professor Vittorio Corbo assembles frontier research on economic policies in emerging-market economies. This book addresses key policy questions in essays, theoretical models, and empirical research, in the fields of macroeconomics, financial integration, and economic development. The volume’s twelve chapters are organized in five major areas. Two essays on development thinking discuss the relation between global trade and growth, and the evolution of development thinking. Three models develop new interpretations of the recent global financial crisis, focusing on financial markets, capital flows, and financial stability. The book’s third part is comprised by three chapters on fiscal sustainability and fiscal rules. Monetary policy and the exchange rate are the subject of two subsequent chapters. The volume’s final part comprises two chapters on the relation between poverty and economic growth, and between trade liberalization and economic performance.

Blurbs

“A fitting collection of essays reflecting Vittorio Corbo’s wide-ranging contributions to economic policy”, Jaime de Melo, Professor, Université de Genève

“This collection of papers well reflects Vittorio’s legacy and impact on hundreds of economists that have had the privilege of interacting with him: policy relevance, rigorous analysis, and a focus on emerging-market economies with an open mind. Thanks, Vittorio!”, Rodrigo Valdés, Minister of Finance of Chile

“Vittorio Corbo is a leading scholar in the macroeconomics of emerging market economies. He has also been actively involved in policymaking as the Governor of the Central Bank of Chile. This volume, which includes twelve original articles presented at a conference honoring his distinguished career, contains theoretical and empirical research conducted by renowned economists in topics which are of paramount interest to emerging economies. For those researchers and policy makers interested in emerging economies, this volume will be of great help in understanding the main policy discussions, trade-offs, and dilemmas facing countries that represent an ever-increasing share of the world economy”, Rodrigo Vergara, Governor, Central Bank of Chile

95 Propuestas para un Chile mejor

Editores: Equipo Grupo Res Publica Chile

Grupo Res Publica Chile, 2013

Descripción

Nuestro país ha avanzado mucho en las últimas décadas. Esos avances ofrecen lecciones y, en muchas materias, son justa causa de orgullo nacional. Pero nada de eso brinda razones para anestesiar el sentido de urgencia por ir más allá. Los logros obtenidos en el pasado –pero especialmente las áreas que no presentan logros en el Chile actual– renuevan los desafíos e imponen exigencias aun mayores. Por ello, los chilenos debemos acelerar la marcha y afinar nuestros sentidos para comprender mejor las complejidades de una sociedad que, junto con los progresos que exhibe, se muestra más exigente, expresa nuevas aspiraciones y revela retrasos, desigualdades, contradicciones y motivos para la perplejidad. El objetivo del Grupo Res Publica Chile es aportar a pensar en nuestro país, identificar esas brechas y falencias a la luz de un diagnóstico técnico y político, y sobre todo presentar propuestas de reformas y cambios para un Chile mejor. Nuestra pretensión es enriquecer la discusión pública necesaria para impulsar las reformas que el país requiere para ser más desarrollado integralmente, socialmente más inclusivo, políticamente más estable y representativo, y con habitantes y comunidades más felices. Este libro es el resultado de nuestro proceso de reflexión y plantea 95 propuestas relacionadas con nuestra realidad política, económica y social.

Monetary Policy Under Uncertainty and Learning

Editors: Klaus Schmidt-Hebbel and Carl Walsh

Central Bank of Chile, 2009

Description

Huge swings in oil, food, and other commodity prices and the global financial crisis are at the core of current monetary policy discussion. The latter events are vivid reminders of how uncertainty, imperfect knowledge, and the need to learn affect macroeconomic behavior and the conduct of monetary policy. Central bank and academic economists conducting research on the design of monetary policy have made significant advances in recent years. However, ongoing limitations of economic theory and data, structural changes in the economy, the inherent unobservability of key macro variables, and disagreements about the right model of the transmission of monetary policy imply that central bankers operate in an environment of both conventional and Knightian uncertainty. Hence economists and policymakers are engaged in continuous learning about the economy. At the same time, the public forms its expectations based on its evolving understanding of the economy and the policymakers' behavior. In this volume, leading international scholars address many of the key issues relevant to central bankers taking decisions under conditions of uncertainty and learning. The 14 essays in this volume offer both theoretical insights and international empirical results on the conduct of monetary policy under uncertainty and learning. The volume also addresses key issues on monetary policy conduct and results in Chile

Blurbs

"The global financial crisis is a powerful reminder of how uncertainty affects the effectiveness and design of demand policies. This book offers a unique collection of contributions that throw light on how monetary authorities can best set, operate and communicate policy when their information about the economy and shocks is imperfect and learning is underway. Undoubtedly a must-read for policymakers and scholars alike as we slide further into unchartered economic territory", Nicoletta Batini, lnternational Monetary Fund

"Two of the most pervasive features of the practice of monetary policy are uncertainty and learning. 80th policymakers and the public have imperfect knowledge about the governing structural relations of the economy, as well as the value of key macroeconomic variables at the time when decisions have to be made. Consequently, both uncertainty and learning affect the way monetary policy is conducted. This book provides important theoretical insights by leading scholars and practitioners about the robustness of traditional monetary policy schemes and the construction of new ones that explicitly take into account uncertainty and learning. This collection also offers several empirical assessments of how some dimensions of uncertainty affect the performance of monetary policy. The book is a must for both scholars and practitioners", Vittorio Corbo, Centro de Estudios Públicos and former Governor of the Central Bank of Chile

"This impressive and timely volume is about how economic actors and policy makers should and do characterize and cope with uncertainties about events and models. These state of the art articles provide good views of the role of the most promising approaches - Bayesian methods for hidden Markov models, adaptive models incorporating least squares learning, models of costly information processing, and even decision making with multiple priors. Recent events have made the issues discussed here only more important", Thomas Sargent, New York University

Monetary Policy Under Inflation Targeting

Editors: Frederic Mishkin and Klaus Schmidt-Hebbel

Central Bank of Chile, 2007

Description

Inflation targeting cum exchange-rate floating has become the framework of choice in countries pursuing an independent and effective monetary policy. Since its adoption by New Zealand (1990) and Chile (1991), central banks of nearly 25 industrial and emerging economies have implemented an explicit inflation target as their nominal anchor. Many more emerging economies are planning to adopt inflation targeting in coming years. The theory and practice of monetary policy under inflation targeting have evolved hand-in-hand, benefiting mutually. This volume presents 14 papers that add substantially to the body of theoretical findings, empirical research, and policy lessons on the conduct of monetary policy under inflation targeting. New theoretical work focuses on the optimality of inflation targeting under different fiscal policies and varying degrees of price stickiness and considering the zero-bound problem. Other analytical research addresses improvements in central bank communication required to raise monetary policy efficiency and analyzes the optimal degree of monetary policy transparency and communication. New findings are provided on the choice between inflation and price-level targeting. This book also presents a large body of new empirical evidence on the role of the exchange rate, pre-conditions at the start of the regime, gains in macro performance and monetary policy efficiency, and anchoring of inflation expectations in inflation-targeting countries, in comparison to non-targeting countries. The transition from partial to full-fledged inflation targeting in Chile receives particular attention, reporting changes in monetary policy rules and in inflation determinants and dynamics

Blurbs

“What is it about these hardy little Southern Hemisphere central banks? Congratulations to the Central Bank of Chile for once again pushing forward the frontiers of practical policy knowledge-this time on one of the more successful tools to enter the policymakers' toolkits in recent decades: inflation targeting. This is state of the science", Alan Bollard, Governor, Reserve Bank of New Zealand

"Sometimes a policy works, and it is worth documenting how and why. That is the case with inflation targeting in emerging markets, and Mishkin and Schmidt-Hebbel have brought together in this volume research from the best academics explaining the how and the why. Sometimes a conference volume is well worth reading, because it gives you most of what you need to know on a critical issue from definitive contributors, and that is the case with this one", Adam S. Posen, Senior Fellow, Peterson Institute for Internacional Economics

"In this excellent collection, top monetary experts from around the world apply a rare combination of economic theory, data analysis, and experience to advance substantially our understanding of one of the most important developments in monetary policy in history: the great inflation-targeting movement. Beginning in Chile and New Zealand, inflation targeting has now spread arollnd the world and, as this book documents, has dramatically reduced inflation and ushered in a period of unprecedented economic stability, especially in emerging markets. I welcome the emphasis on the policy problems facing small open economies, including the complex interaction of exchange rate fluctuations and inflation-targeting goals", John Taylor, Mary and Robert Raymond Professor of Economics, Stanford University

General Equilibrium Models For The Chilean Economy

Editors: Rómulo Chumacero and Klaus Schmidt-Hebbel

Central Bank of Chile, 2005

Description

General equilibrium theory and modeling have proved to be useful for understanding economic interactions between markets and agents and the determination of prices and quantities. Applied general equilibrium models (GEM) have been developed and used to address a wide range of theoretical questions and empirical/policy issues, in the fields of macroeconomics, international trade, public finance, and environmental analysis, among others.

This volume—the first of its kind in Chile—comprises a representative collection of recent GEM research and applications that illustrate the usefulness and relevance of frontier general equilibrium tools for better understanding aggregate structures and policy responses. It should be of interest to academics and policymakers in Chile and elsewhere, for several reasons. First, Chile is known for implementing bold and innovative economic policies. The assessment and quantification of potential effects is particularly valuable when performed by using the types of models presented herein. Second, this book includes a variety of methodological choices available to address key issues. The thoughtful combination of empirical and theoretical considerations informs the user about model strengths and weaknesses and the types of questions that they are able to address. Finally, the volume also presents some novel methodological contributions to the empirical and theoretical literature on general equilibrium models.

The broad scope of the issues covered and the wide spectrum of methodological choices presented in this book show how active the profession is in providing a better characterization and a more precise evaluation of policy reforms. Vigorous contrast of different perspectives and rigorous academic debate of these topics are invaluable for contributing to more informed policy decisions

Blurbs

“This volume includes a valuable collection of studies that apply general equilibrium models to a range of Chilean policy questions. These studies assess systematically a number of the innovative policies that have been introduced in Chile using a variety of methodological approaches. The compliation of the different approaches into one set of studies, moreover, illustrates a number of strengths and weaknesses of the different approaches. The collection will be very useful, therefore, for academics andpolicymakers not only with interests in Chile but also with interests in general equilibrium analysis of other economies”, Jere Behrman, University of Pennsylvania

“This book contains a rich set of applied general equilibrium studies that address a number of important Chilean policy issues. The book is of value to both academics and policymakers in Chile and elsewhere. The general equilibrium methods developed and applied in these studies can be used to assess quantitatively the consequences of innovative economic policies that are under consideration, or warrant consideration”, Edward Prescott, Arizona State University, Nobel Prize for Economic Sciences

Indexation, Inflation, and Monetary Policy

Editors: Fernando Lefort and Klaus Schmidt-Hebbel

Central Bank of Chile, 2002

Description

Although indexation policies and practices are common in many markets and economies, their implications for market efficiency and price stabilization remain controversial. This book contributes to the literature on indexation and inflation by including nine articles that are at the research frontier on these issues. The scope of the articles ranges from specific topics—including the optimal management of indexed public debt and the consequences of wage indexation—to recent empirical evidence regarding indexation and the persistence of inflation. The authors look at specific indexation practices adopted in different markets in response to inflation, discuss the consequences of such practices for these markets, and analyze the relationship among indexation mechanisms, inflation persistence, and the outcome of stabilization programs

Blurbs

"This volume includes a valuable collection of studies that apply general equilibrim models to a range of Chilean policy questions. These studies assess systematically a number of the innovative policies that have been introduced in Chile using a variety of methodological approaches. The compilation of the different approaches into one set of studies, moreover, illustrates a number of strengths and weaknesses of the different approaches. The collection will be very useful, therefore, for academics and policymakers not only with interests in Chile. But also with interests in general equilibrium analysis of other economies", Guillermo A. Calvo, University of Maryland and Inter-American Development Bank

"This volume presents the current state of knowledge about the classic issues of indexation and inflation. It brings together work by top economist in both academia and central banks. The paper strike just the rigth balance between intellectual rigor and policy relevance. Any scholar or practitioner of monetary policy can learn a lot from this book", Laurence Ball, Johns Hopkins University

"Indexation of wages, exchange rates, tax brackets, bonds, mortgages, rents -Chile, has had it all. Building on this rich experience, the volume edited by Lefort and Schmidt-Hebbel provides a state-of-the-art analysis of the macroeconomic causes and consequences if indexation. Inflation-targeting central bankers will want to read the chapters on how to carry out policy in an indexed environment. A very useful book", Andrés Velasco, Harvard University

Banking, Financial Integration, and International Crises

Editors: Luis Hernández and Klaus Schmidt-Hebbel

Central Bank of Chile, 2002

Description

Financial integration during the past decade has enhanced market discipline but also caused greater strain in many emerging market economies' financial sectors, especially their banking systems. The potential benefits of financial integration, although large in the long run, may be outweighed in the short run if the transition process is inadequately managed and countries end up in a crisis. There is great need, especially among policy makers in developing countries, for policy advice on how to become financially integrated without increasing macro financial vulnerability.

This book attempts to partly fulfill this need by presenting new research on the relationship among institutional development, financial development, economic growth, boom-bust cycles and banking crises. Since understanding these relationships is essential to properly manage the transition towards full financial integration, this book should be of interest to policy makers and development economists alike.

Blurbs

"Integrating financial intermediation into macroeconomic analysis is urgent in the wake of the many episodies of "twin crises" that the world has witnessed in recent years. This outstanding collection of articles by an impressive group of experts in the field addresses the issue in full - from the role of financial intermediation in long-run growth, to the role of intermediaries in generating and propagating crises and that of financial policies in post-crisis recovery . This collection provides insights and ample food for thought in all these areas. It belongs on the bookshelf of of any serious macroeconomist trying to understand how macroeconomics-financial sector links can affect the economy's performance", Peter J. Montiel, Williams College

"Integration into international financial markets is no substitute for good macroeconomic management and sound domestic financial institutions. Quite the contrary, they complement each other well. Altoghether, the articles in this book offer an unusually rich and informative perspective on the perils of financial integration, along with the policies and institutions that work and do not work in this process. A tour de force for theorists and practitioners alike", Ricardo J. Caballero, Massachusetts Institute of Technology

"In recent years, recognition of the importance of a healthy financial system to economic growth and the prevention of very costly financial crises has grown. This book contains a very useful collection of essays exploring the causes of recent international fonancial crises andt the steps necessary to improve the performance of banking and financial systems in emerging markets of banking and financial systems in emerging market countries. Valuable reading for researchers and policymakers alike", Frederic S. Mishkin, Columbia University

Monetary Policy: Rules and Transmission Mechanisms

Editors: Norman Loayza and Klaus Schmidt-Hebbel

Central Bank of Chile, 2002

Description

Monetary policy must consider the bidirectional relationship between the economy and its central bank. It should therefore address two essential questions: first, how changes in the economy induce a reaction by the central bank, and second, how these policy changes are in turn transmitted to the economy.

The essays in this volume present and discuss some recent advances in research on monetary policy rules and monetary transmission mechanisms. In addressing these issues, the papers take a variety of approaches, from case studies on developed and emerging economies to cross-country empirical analyses, and from theoretical models to historical narrative. Together they clarify some key issues of monetary policy, such as the tradeoff between output and inflation volatilities, the importance of central bank credibility, the additional complexities of policymaking in open economies, and the limits that uncertainty places on policy decisions.

Blurbs

"This is a first-rate treatise on monetary policy in emerging countries. The contributors are first-rate academics and practitioners. They provide deep insights and rigorous analysis. This book is a must read for anyone interested in undertstanding the contribution of monetary policy to stability, growth and prosperity, Definitely, a home run!", Sebastian Edwards, University of California, Los Angeles

"The achievement of low and stable rates of inflation worldwide has come hand in hand with a growing interest by central banks in the promotion and in-house production of high-level, policy-relevant research in monetary economics, as exemplified by the papers in the present volume. The Central Bank of Chile deserves high marks in both fronts", Jordi Galí, Universitat Pompeu Fabra

"This addition to a new series of volumes, representing the highly regarded annual conferences held by the Central bank of Chile, is most welcome. In it, leading academic and central bank analysts consider a wide variety of issues concerning the design of monetary policy rules, the specification of transmission mechanisms (i.e., macroeconomic structures), and the interaction of these. A notable feature is the inclusion of full quantitative studies for six different economies -Australia, Canada, Chile, Israel, South Africa, and the U.K. - plus informative policy-rule estimates for five Latin American economies", Benett t. McCallum, Carnegie Mellon University

The Economics of Saving and Growth: Theory, Evidence, and Implications for Policy

Editors: Klaus Schmidt-Hebbel and Luis Servén

Cambridge University Press, 1999

Description

Saving rates display great variation across countries and over time. They are also closely related to growth performance. This 1999 volume provides an account of key variables, institutions and policies that determine saving. Drawing from a systematic exploration of the existing literature, the collection summarizes knowledge about cross-country saving trends, the relation between saving and growth, the impact of financial policies and institutions on saving, the effect of foreign resource inflows on saving, and the links between income distribution and aggregate saving. In addition, new research results are presented on the two latter areas. The work has a strong empirical motivation: to help address real-world issues on consumption and saving in both industrial and developing countries, in order to assist in the design of rational and effective macroeconomic policies.

Blurbs

"The Economics of Saving and Growth provides a lucid and comprehensive treatment of the nature of saving and its role in the growth process. Within its covers, the contributors study the theorical relationships between various macroeconomic factors and saving and growth as well as empirical evidence in a concise but self-contained style. Besides being an excellent and up-to-date starting point for any research in this area, the book is an invaluable resource for policy-makers, particularly in developing countries” Sebastian Edwards, UCLA

“This little book comprises the state of the art in an important field. Understanding saving behavior is crucial to our understanding of growth and development; this is never more true than today, when the Asian model of high saving and investment is being called into question. These six chapters by some of the best researchers in the field shed much light on the most important empirical and theoretical issues concerning saving and growth, and should be required reading for all economists"

Paul Masson, International Monetary Fund

"This book provides a comprehensive analysis of the relation between saving and growth and of the institutions and policies that affect such a relation. By successfully bridging the gap between theoretical models and empirical issues, it will be useful for policy makers and researchers alike"

Tullio Jappelli, University of Salerno

Public Sector Deficits and Macroeconomic Performance

Editors: William Easterly, Carlos Alfredo Rodríguez and Klaus Schmidt-Hebbel

Oxford University Press and The World Bank, 1994

Description

In the 1980s chronic public sector deficits forced countries to undertake fiscal adjustment. The need to face hard choices continues in the 1990s. But the problem is not a simple and easily diagnosed one with an obvious solution. Rather, public sector deficits have had widely differing consequences; high inflation in some countries, low inflation but also low investment and growth in others, and in still others no evident short-term macroeconomic spillovers. This book presents the findings of a World Bank research project designed to shed light on the complex dynamics of public sector deficits. It includes an in-depth examination of eight countries: Argentina, Chile, Colombia, Cote d'Ivoire, Ghana, Morocco, Pakistan, and Zimbabwe. These cases are analyzed within a comprehensive theoretical framework elaborated for the study and in conjunction with cross-country data from a larger set. The book draws the following conclusions. The ways chosen to finance deficits - money creation, debt, or arrears - go far to explain medium-term financial and macroeconomic imbalances, but in the short term these relations are blurred. Deficits tend to be bad for growth; they increase financial and price instability and crowd out private investment. Public saving typically reduces private saving only slightly; increasing public saving is a very effective policy instrument for raising national saving. Fiscal adjustment typically leads to a lower trade deficit and a more depreciated real exchange rate. Finally, the blame for large, systemic public deficits must be placed not on bad luck but on unwise policy choices - and, conversely, sound fiscal policies can set a country on a path leading to stability and growth.

Del Auge a la Crisis de 1982

Editores: Felipe Morandé y Klaus Schmidt-Hebbel

ILADES/Georgetown University, 1998

Descripción

El presente libro constituye un aporte serio y sistemático al estudio de las relaciones entre variables macroeconómicas y financieras en la experiencia chilena que se inicia a mediados de los setenta y culmina en la gran recesión de 1982, con un énfasis especial en la interacción entre apertura financiera, endeudamiento externo y sobregasto privado, lo que naturalmente involucra el funcionamiento de los mercados de capitales. Este objetivo se cumple a través de la exposición de siete ensayos de igual número de destacados expertos en la economía chilena, cuya presentación en un solo volumen constituirá una referencia obligada en todo análisis histórico del período y en cualquier intento de extraer de este lecciones para el futuro.

By Martín Carrasco (martinjcarrasco@gmail.com) Klaus Schmidt-Hebbel